|

Everyone feels tired now and then. But, If you continue to feel tired for weeks in a row, it's time to see your doctor. They may be able to help you find out what's causing your fatigue. In fact, your doctor may even suggest you become more active, as exercise may reduce fatigue and improve quality of life.

Sometimes, fatigue can be the first sign that something is wrong in your body. For example, people with COPD, often complain of fatigue. People with cancer may feel fatigued from the disease, the treatments, or both. Fatigue can be attributed to many medical conditions including:

Emotional stresses can take a toll on your energy. Fatigue can be linked to many conditions, including:

Some lifestyle habits can add to fatigue:

How can I feel less fatigued? Some changes to your lifestyle can make you feel less tired:

When should I see a doctor for fatigue? If you've been tired for several weeks with no relief, it may be time to call your healthcare provider. He or she will ask questions about your sleep, daily activities, appetite, and exercise and will likely give you a physical exam and order lab tests. Your treatment will be based on your history and the results of your exam. Your doctor may prescribe medications to target underlying health problems. Medicare Supplement Insurance, often referred to as Medigap, is insurance that helps fill "gaps” in Original Medicare insurance and is sold by private companies. Original Medicare pays a significant portion of the cost for covered health care services and supplies but not the full cost. A Medicare Supplement Insurance policy (Medigap) can help pay some of the remaining health care costs such as copayments, coinsurance, and deductibles.

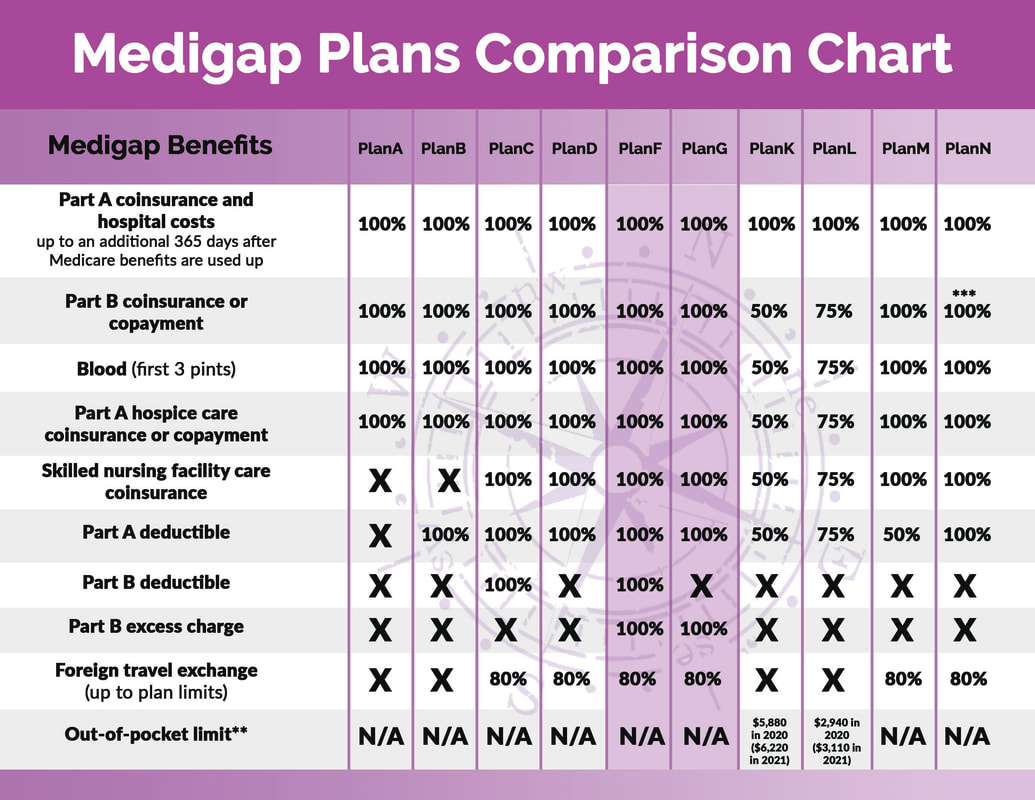

There are significant overlaps between many of the plans so you may find the chart below helpful to compare and contrast your options. * Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year. *** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission. Medicare Supplement Plan A: Medicare Supplement insurance Plan A is different from Medicare Part A, although their similar names may be confusingly similar. Medicare Part A covers inpatient hospital care and is one half of Medicare (Part A and Part B). Medicare Supplement insurance Plan A provides coverage that helps pay for out-of-pocket costs from Medicare Part A and Part B. Medicare Supplement Plan B: Medicare Supplemental insurance Plan B is different from Medicare Part B, although their similar names may be confusingly similar. Medicare Supplemental Plan B covers

Medicare Supplement Plan C covers:

Medicare Supplement Plan D Covers:

Medicare Supplement Plan F covers:

Medicare Supplement Plan G covers:

Medicare Supplement Plan K covers:

Medicare Supplement Plan L covers: 100% of the cost of:

Medicare Supplement Plan M covers:

Medicare Supplement Plan N covers:

When someone you love dies, the job of handling the personal and legal details may feel overwhelming during a time of grief. It is a big responsibility that can take a year or more to complete. It is unlikely you will be able to do it alone. Settling a deceased family member's affairs is not a one-person task. You may need the help of others, ranging from lawyers and CPA’s to funeral directors and movers. Also don’t be afraid to ask for help from trusted friends and relatives. Making a list details that need to be addressed will help keep you organized and prevent things from slipping through the cracks. This guide will get you started. 1. Get a legal pronouncement of death As soon as possible, the death must be officially pronounced by someone in authority like a doctor in a hospital or nursing facility or a hospice nurse. This person also fills out the forms certifying the cause, time, and place of death. These steps will make it possible for an official death certificate to be prepared. This legal form is necessary for many reasons, including life insurance and property issues. 2. Arrange for transportation of the body Arrangements should be made to pick up the body as soon as the family is ready and according to local laws. This can be done by a funeral home or by the family themselves in most states. If the death takes place in a hospital or nursing facility, they may help with these arrangements. If at home, you will need to contact a funeral home directly. 3. Notify family and friends How to notify friends and family is a personal choice. You may choose to send out a group text or mass email or make individual phone calls to let people know their loved one has died. Ask the recipients to spread the word by notifying others connected to the deceased. 4. Locate Important Papers Find the deceased’s important papers and documents as soon as possible. If necessary, ask close family, friends, or the deceased's doctor or lawyer if they know where these important papers can be found, and the location of a bank safety deposit box, if any. You will want to seek out the Will, insurance policies, titles, deeds, trusts, bank accounts, power of attorney etc. 5. Arrange for care of dependents If the deceased has dependent children or perhaps is the primary care giver for a spouse or other family member it will be necessary to make arrangements for the care of the dependent. This care can look very different depending on the age, health and mental capacity of the dependent. Initially it may be easiest for a family member to fill the role while a long-term plan is developed. If plans are not made in advance and you need to research options, the Department of Social and Health Services may be a good place to start. 6. Arrange for care of pets When selecting a caregiver for pets, consider partners, adult children, parents, brothers, sisters, and friends who have met your pet and have successfully cared for pets themselves. Remember, the new owner will have full discretion over the animal’s care including veterinary treatment and euthanasia. If there is no one available to take the pet it may be necessary to contact a local animal shelter. 7. Contact person’s employer Contact the deceased’s employer and ask about any possible death benefits, retirement annuity or pension plans, and life and health insurance coverage. Unions and other professional organizations may provide benefits also. Sometimes you may need to return the deceased’s final monthly pension payment to the pension company before they send a new, adjusted payment. 8. Arrange for funeral Planning a funeral or memorial service is a highly personal process. Your decisions will be shaped by your life experiences, relationship to the deceased, what the deceased wanted, religious beliefs, and myriad other factors. 9. Arrange to look after persons home and collect mail To forward the persons mail to yourself at a different address you will need to file a request at your local post office. Bring proof that you are the executor or administrator authorized to manage the deceased’s mail then fill out a forwarding change of address form. 10. Make sure important bills continue to be paid Unpaid debt becomes the responsibility of the deceased person’s estate. The trustee responsible for overseeing the estate first will use any assets in the estate to pay creditors before dividing the assets among the heirs according to the deceased’s will, if there is one. This process is called probate. Making sure property taxes, mortgage payments and certain utilities remain current will help you avoid complications down the road. Also be sure to cancel services that may no longer be needed such as phone and television. 11. Get multiple copies of death certificate In order to close many accounts, the companies involved will likely want a copy of the death certificate, especially when financial assets are involved. To order copies of a death certificate, contact the county or state vital records office in the place where the death occurred. They will tell you exactly what you need to do. In Washington state you can find the Information on the Department of Health website. 12. Additional contacts you may want to make:

|

AuthorTyice Strahl Categories

All

Archives

May 2023

|

- Home

-

Settings

- Assisted Living

- Home Care

- Independent Living

- Memory Care

- Skilled Nursing

- Adult Family Homes

-

All Communities

>

- Aspen Quality Care

- Avamere South Hill

- Brighton Court

- Brookdale Nine Mile

- Brookdale Park Place

- Cheney Assisted Living

- Cherrywood Assisted Living

- Colonial Court

- Cornerstone Court

- Evergreen Fountains

- Palouse Country

- Fairview Assisted Living

- Fairwinds

- Fairwood

- Fieldstone Memory Care

- Good Samaritan

- Maplewood Gardens

- Moran Vista

- North Point Village

- Orchard Crest

- Pine Ridge Memory Care

- Emilie Court

- Ridgeview Place

- Riverview Retirement

- Rockwood Retirement Community

- Rose Pointe Assisted Living

- Royal Park

- South Hill Village

- Sullivan Park Assisted Living

- Sunshine Health Facilities

- Touchmark Assisted Living

- Willow Grove

- Wind River

- Alderwood Manor

- Franklin Hills

- Manor Care

- North Central Care Center

- Providence St Joseph

- Regency at Northpointe

- Royal Park Health and Rehabilitation

- Spokane Veterans Home

- The Gardens on University

- Spokane Assisted Living Directory

- Locations

- Services

- About

- Senior Living Blog

- Contact

RSS Feed

RSS Feed