|

Medicare Supplement Insurance, often referred to as Medigap, is insurance that helps fill "gaps” in Original Medicare insurance and is sold by private companies. Original Medicare pays a significant portion of the cost for covered health care services and supplies but not the full cost. A Medicare Supplement Insurance policy (Medigap) can help pay some of the remaining health care costs such as copayments, coinsurance, and deductibles.

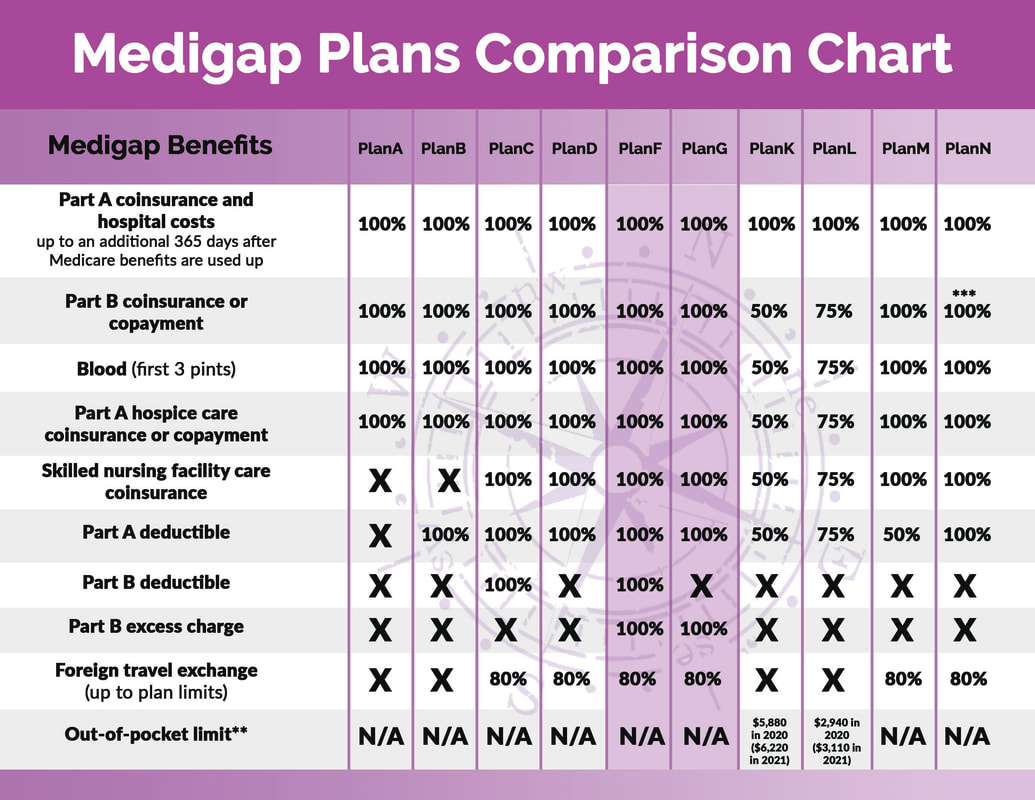

There are significant overlaps between many of the plans so you may find the chart below helpful to compare and contrast your options. * Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year. *** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission. Medicare Supplement Plan A: Medicare Supplement insurance Plan A is different from Medicare Part A, although their similar names may be confusingly similar. Medicare Part A covers inpatient hospital care and is one half of Medicare (Part A and Part B). Medicare Supplement insurance Plan A provides coverage that helps pay for out-of-pocket costs from Medicare Part A and Part B. Medicare Supplement Plan B: Medicare Supplemental insurance Plan B is different from Medicare Part B, although their similar names may be confusingly similar. Medicare Supplemental Plan B covers

Medicare Supplement Plan C covers:

Medicare Supplement Plan D Covers:

Medicare Supplement Plan F covers:

Medicare Supplement Plan G covers:

Medicare Supplement Plan K covers:

Medicare Supplement Plan L covers: 100% of the cost of:

Medicare Supplement Plan M covers:

Medicare Supplement Plan N covers:

2/28/2022 03:12:31 am

My uncle is thinking about early retirement so he can play video games around his retirement home. I like your idea of investing in health insurance plans that can cover any additional fees that he might incur when he gets sick. I should relay this information to him so he'd consider seeking a supplement agent for advice. Comments are closed.

|

AuthorTyice Strahl Categories

All

Archives

May 2023

|

- Home

-

Settings

- Assisted Living

- Home Care

- Independent Living

- Memory Care

- Skilled Nursing

- Adult Family Homes

-

All Communities

>

- Aspen Quality Care

- Avamere South Hill

- Brighton Court

- Brookdale Nine Mile

- Brookdale Park Place

- Cheney Assisted Living

- Cherrywood Assisted Living

- Colonial Court

- Cornerstone Court

- Evergreen Fountains

- Palouse Country

- Fairview Assisted Living

- Fairwinds

- Fairwood

- Fieldstone Memory Care

- Good Samaritan

- Maplewood Gardens

- Moran Vista

- North Point Village

- Orchard Crest

- Pine Ridge Memory Care

- Emilie Court

- Ridgeview Place

- Riverview Retirement

- Rockwood Retirement Community

- Rose Pointe Assisted Living

- Royal Park

- South Hill Village

- Sullivan Park Assisted Living

- Sunshine Health Facilities

- Touchmark Assisted Living

- Willow Grove

- Wind River

- Alderwood Manor

- Franklin Hills

- Manor Care

- North Central Care Center

- Providence St Joseph

- Regency at Northpointe

- Royal Park Health and Rehabilitation

- Spokane Veterans Home

- The Gardens on University

- Spokane Assisted Living Directory

- Locations

- Services

- About

- Senior Living Blog

- Contact

RSS Feed

RSS Feed